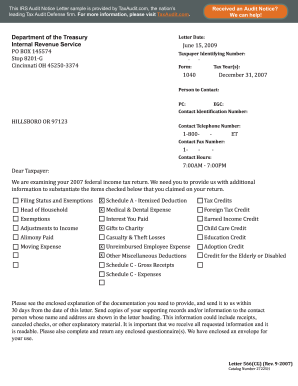

IRS Letter 566(CG) 2010-2025 free printable template

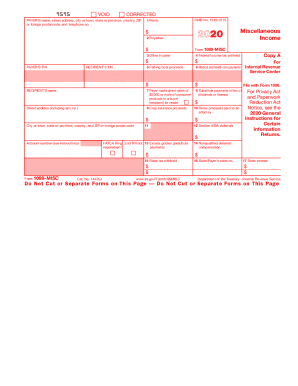

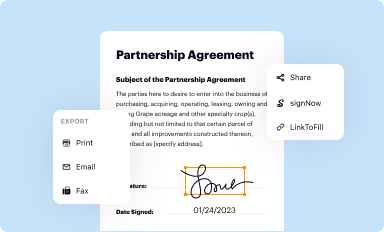

Get, Create, Make and Sign form 13825

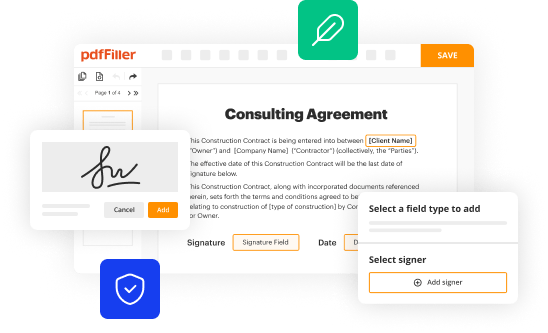

How to edit tax box check online

IRS Letter 566(CG) Form Versions

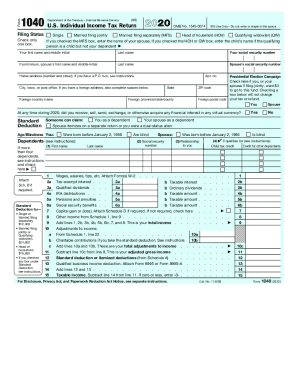

How to fill out tax return line form

How to fill out IRS Letter 566(CG)

Who needs IRS Letter 566(CG)?

Video instructions and help with filling out and completing tax return check

Instructions and Help about tax return 1040

Welcome to tax teach I hope you're all having a great day my name is Sean I'm a certified public accountant specializing in taxation today I want to talk about how to fill out schedule 8812 the child tax credit schedule now you need to fill out the schedule in order to receive the child tax credit which can be as high as 3 600 if you have children 5 and younger or if you have children that are older than 5 so 6 to 17 you can get up to 3 000 for the 2021 tax year so without further ado I'm going to get into how to fill out the child tax credit schedule 8812. All right here's schedule 8812 credits for qualifying children and other dependents and in this example I'm going to assume the taxpayer Jane Doe is a single mother of two children one child being the age of five and one child being the age of eight so with that fact pattern I'm going to go over how to fill out this schedule so let's get into it part one dash a child attachment other credit for other dependents line one enter the amount...

People Also Ask about return schedule

When should I expect my tax refund 2023?

Are tax refunds delayed 2023?

When can I expect tax return?

What tax return means?

How to get a tax refund?

Is it better to owe or get a refund?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

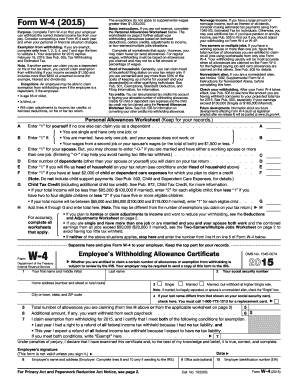

Where do I find itemized deduction?

How do I complete deductions deduction spouse online?

How can I fill out tax return deductions on an iOS device?

What is IRS Letter 566(CG)?

Who is required to file IRS Letter 566(CG)?

How to fill out IRS Letter 566(CG)?

What is the purpose of IRS Letter 566(CG)?

What information must be reported on IRS Letter 566(CG)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.