Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

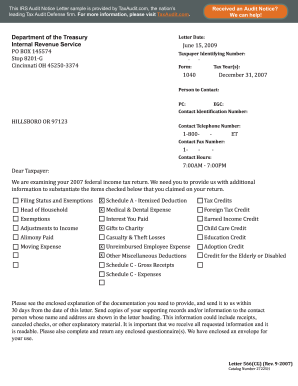

What is tax return check?

A tax return check is a check issued by the Internal Revenue Service (IRS) to taxpayers who paid more taxes than they owed. The check is used to refund the overpaid amount. Usually, the check is issued within 3 weeks of filing a tax return.

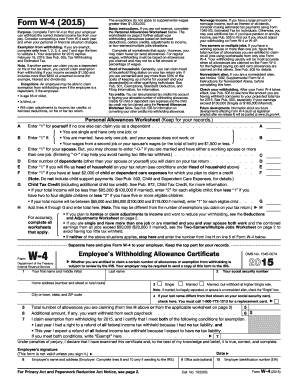

How to fill out tax return check?

The best way to fill out a tax return check is to first gather all the necessary documents and forms. This includes the tax return, any necessary supporting documents, and the check. Once these are gathered, the taxpayer should fill out their name, address, and social security number on the check. Then, the taxpayer should fill out the amount of the check. The taxpayer should make sure to write the total amount of the refund in words and numerals. Next, the taxpayer should attach the tax return, any documents, and the check to a return envelope and mail it to the Internal Revenue Service (IRS).

What is the penalty for the late filing of tax return check?

The penalty for the late filing of a tax return is typically 5% of the unpaid taxes for each month the return is late, up to a maximum of 25%. Additionally, if the return is more than 60 days late, the minimum penalty is the smaller of $135 or 100% of the unpaid tax.

Who is required to file tax return check?

The requirement to file a tax return check varies depending on the jurisdiction, income level, filing status, and age of the taxpayer. In the United States, for example, individuals are generally required to file a federal tax return if their income meets certain thresholds. These thresholds depend on factors such as filing status (single, married filing jointly, head of household, etc.) and age. It is advisable to consult with a tax professional or refer to the tax laws of the specific jurisdiction for accurate and up-to-date information.

What is the purpose of tax return check?

The purpose of a tax return check is to return any excess amount of money that an individual or business has paid to the government in the form of taxes. It is a refund of the overpaid taxes, and it is typically received by taxpayers who have paid more in taxes throughout the year than what they owe. The tax return check aims to ensure that taxpayers do not pay more than their fair share of taxes and allows them to recover any excess amount.

What information must be reported on tax return check?

The specific information that must be reported on a tax return check may vary depending on the tax jurisdiction and the type of tax return being filed. However, some common information that is typically required includes:

1. Name and address of the taxpayer: This includes the individual's or business's legal name and current address.

2. Social Security Number (SSN) or Taxpayer Identification Number (TIN): Personal identification numbers are used to track and identify individuals for tax purposes.

3. Filing status: The taxpayer must indicate their filing status, such as single, married filing jointly, married filing separately, or head of household.

4. Income: Details about the taxpayer's income must be reported, including wages, salaries, self-employment income, rental income, investment income, and any other sources of income.

5. Deductions and credits: Taxpayers must report any eligible deductions and credits that they can claim to reduce their taxable income and lower their overall tax liability.

6. Taxes paid: Any federal or state income taxes withheld from wages or other sources, estimated tax payments, and any other applicable taxes must be reported.

7. Refund or amount owed: Taxpayers must indicate whether they expect a refund or owe additional taxes and provide bank account information for direct deposit or payment details.

8. Signatures: The taxpayer and, if applicable, their spouse or legal representative must sign and date the tax return check to verify that the information provided is accurate and complete.

It is important to refer to the official tax forms and instructions provided by the tax authority in your jurisdiction for specific requirements and any additional information that may be necessary.

When is the deadline to file tax return check in 2023?

The deadline to file tax return checks in 2023 will depend on the country or jurisdiction you are in. In the United States, for example, the tax return filing deadline is typically April 15th, unless it falls on a weekend or holiday, in which case the deadline is shifted to the following business day. However, it's always best to check with your local tax authority or consult a tax professional for the most accurate and up-to-date information regarding tax filing deadlines in your specific location.

Where do I find tax return check?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific itemized deductions form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete schedule 1040 online?

pdfFiller makes it easy to finish and sign tax return line online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I fill out itemized deduction on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your allowable itemized deductions form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.